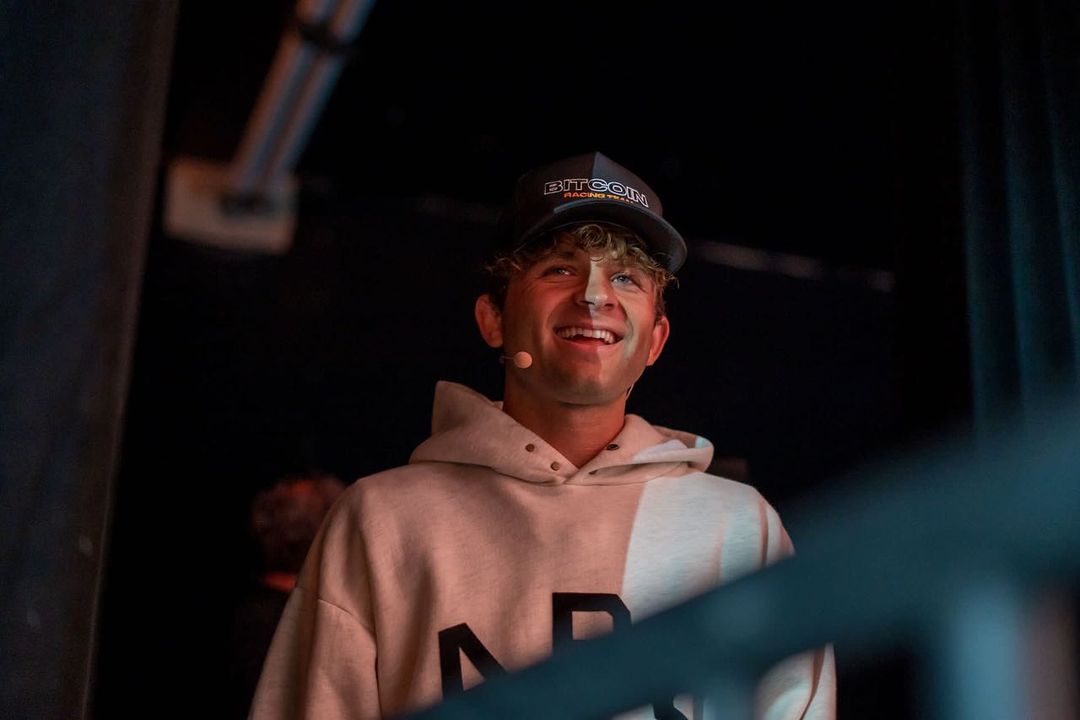

Jack Mallers Net Worth: The Financial Journey of a Fintech Visionary

Jack Mallers is a prominent figure in the fintech industry, widely known for his work in the realm of cryptocurrency and blockchain technology. As the founder and CEO of Strike, a popular Bitcoin-based payment and remittance platform, Mallers has played a crucial role in advancing the adoption of digital currencies around the world. This article will explore his career, known sources of income, net worth estimates from various sources, and his involvement in and attitude towards cryptocurrencies.

How did Jack Mallers become rich?

Jack Mallers’ journey to financial success began with his early interest in technology and computer programming. He quickly made a name for himself in the world of cryptocurrency by developing Zap, a Bitcoin wallet and Lightning Network client, which aimed to facilitate faster and more efficient transactions.

His dedication to enhancing the world of digital currency led him to create Strike in 2019, a platform that allows users to make payments and remittances using Bitcoin with minimal fees. Strike has garnered widespread attention and experienced rapid growth, with millions of users worldwide. Mallers’ vision and technological prowess have propelled him to the forefront of the fintech industry, earning him both recognition and wealth.

How does he make money?

Jack Mallers’ primary source of income is derived from his role as the founder and CEO of Strike. The platform generates revenue through transaction fees and premium services offered to users. As the company continues to grow and expand globally, Mallers’ income is expected to increase in tandem with Strike’s success.

In addition to Strike, Mallers has been involved in various projects within the cryptocurrency and blockchain space. His work as a developer and consultant has contributed to his income, with clients seeking his expertise to build or improve their own digital currency platforms and applications.

Mallers has also participated in the trading and investing of cryptocurrencies, further augmenting his income. His early involvement in the crypto market and deep understanding of the technology has positioned him well to capitalize on the rapidly evolving digital currency landscape.

Jack Mallers Net Worth 2023

Estimating Jack Mallers’ net worth proves to be a challenge, as his primary source of income is tied to the privately-held company, Strike. However, given the platform’s success and his involvement in the cryptocurrency industry, it is reasonable to assume that Mallers has accumulated significant wealth.

While there are no widely published figures on his net worth, financial experts and industry insiders speculate that Mallers is worth millions of dollars, with some estimates reaching into the tens of millions. These estimates are based on Strike’s growth and potential valuation, as well as Mallers’ income from other projects and investments in the cryptocurrency space.

Crypto Assets

Jack Mallers has been a vocal proponent of cryptocurrencies, specifically Bitcoin, throughout his career. He views digital currencies as a means to foster financial freedom and empowerment, reduce dependency on traditional banking systems, and facilitate cross-border transactions with minimal fees.

Mallers’ expertise in cryptocurrency is demonstrated by his various projects, including Zap and Strike, which have focused on simplifying and improving the Bitcoin ecosystem. It is highly likely that he owns a significant amount of Bitcoin and other cryptocurrencies, considering his early involvement in the market and his role as a prominent figure in the industry.

Mallers has consistently advocated for the widespread adoption of cryptocurrencies and the development of user-friendly applications to make them more accessible to the general public. In interviews and public appearances, he emphasizes the importance of understanding and embracing the potential of digital currencies, while also acknowledging the need for responsible innovation and regulatory compliance.

| Monthly Income | unstable |

| Annual Income | $1m |

| Actual Net Worth | $55m |

| One Year Net Worth Forecast | $60m |